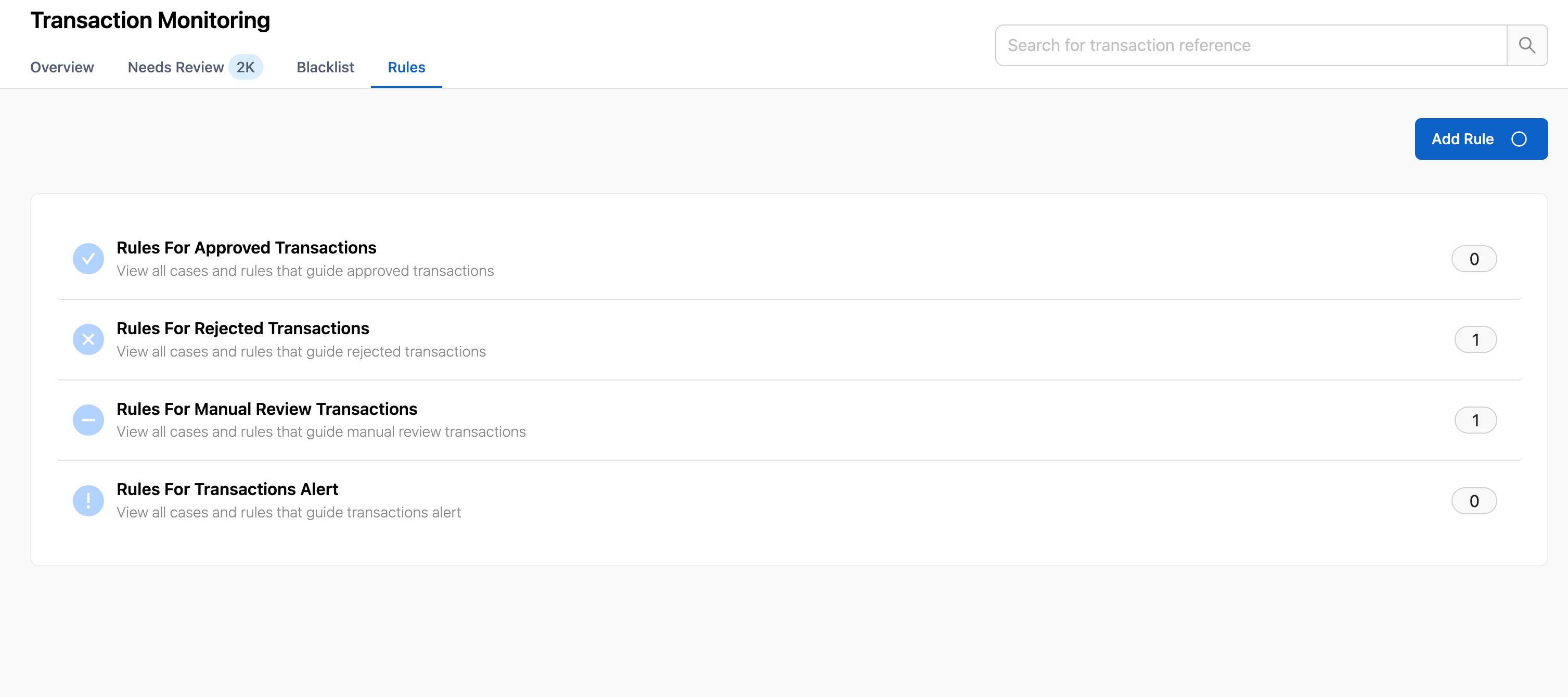

Rules

What are Rules?

How To Create A Rule?

- Click on add rule:

- From transaction monitoring module, click on rules tab, then 'add rule' button

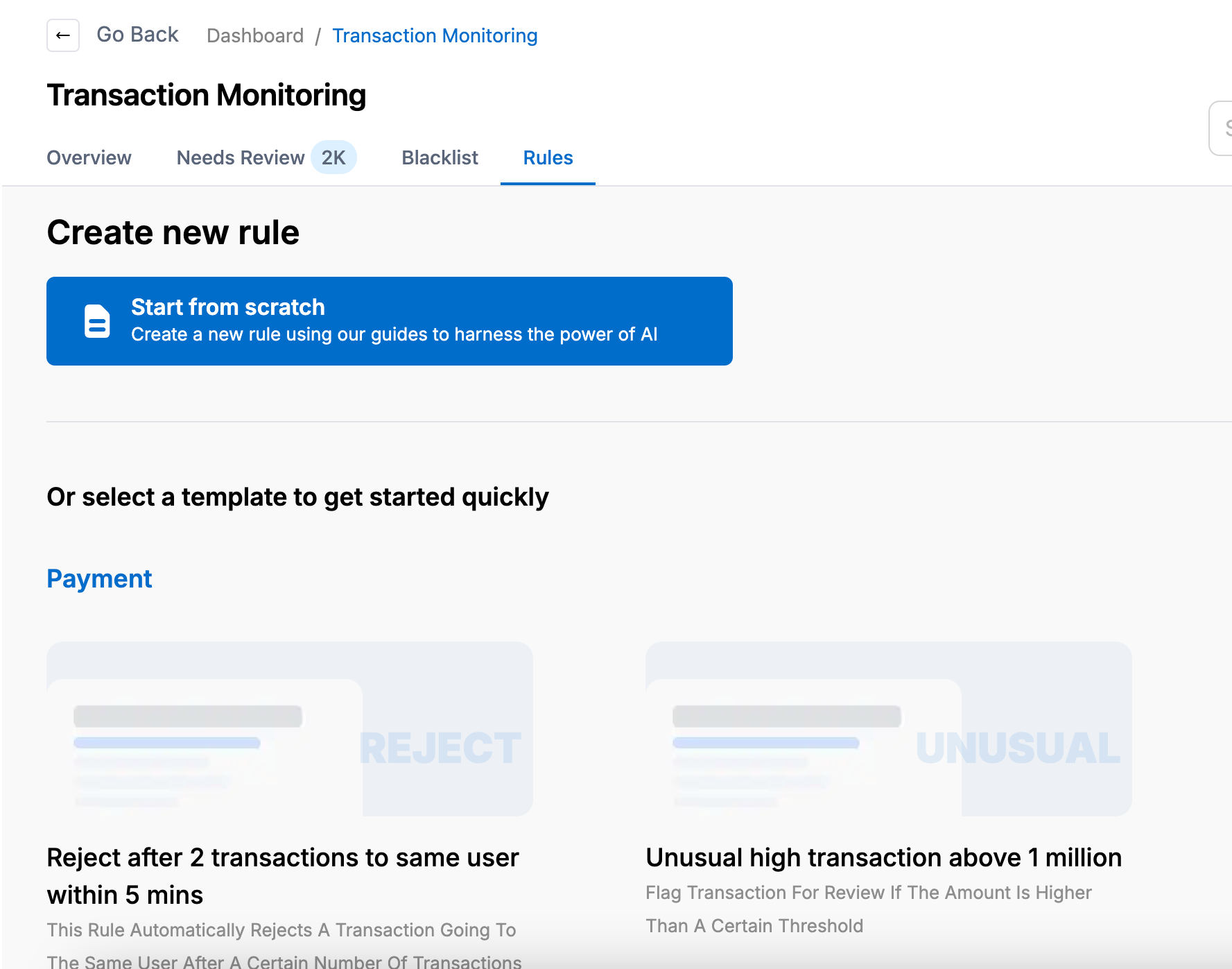

- Create from scratch or select a predefined template:

- You can choose to create a rule from scratch or select from our list of predefined rules template

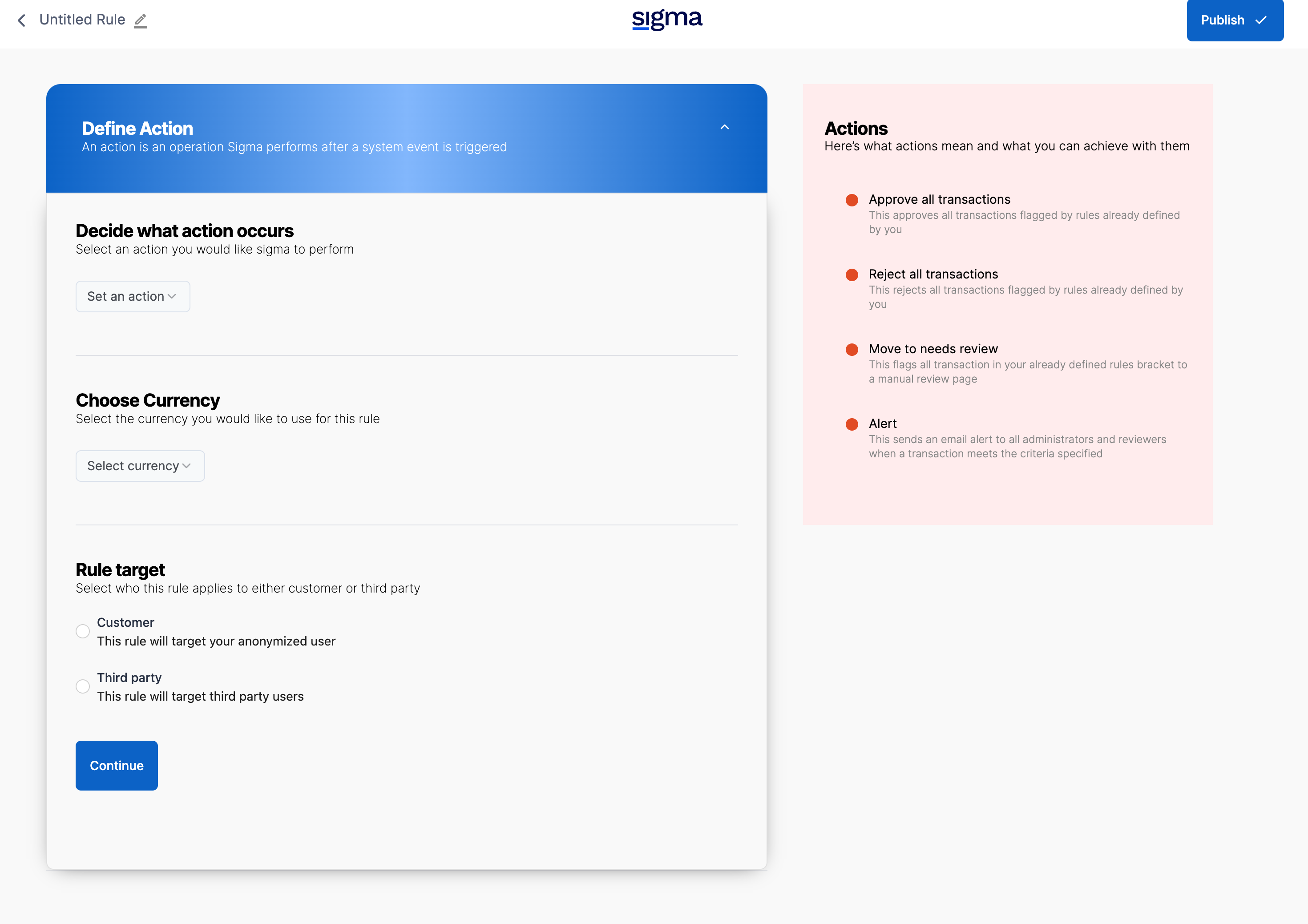

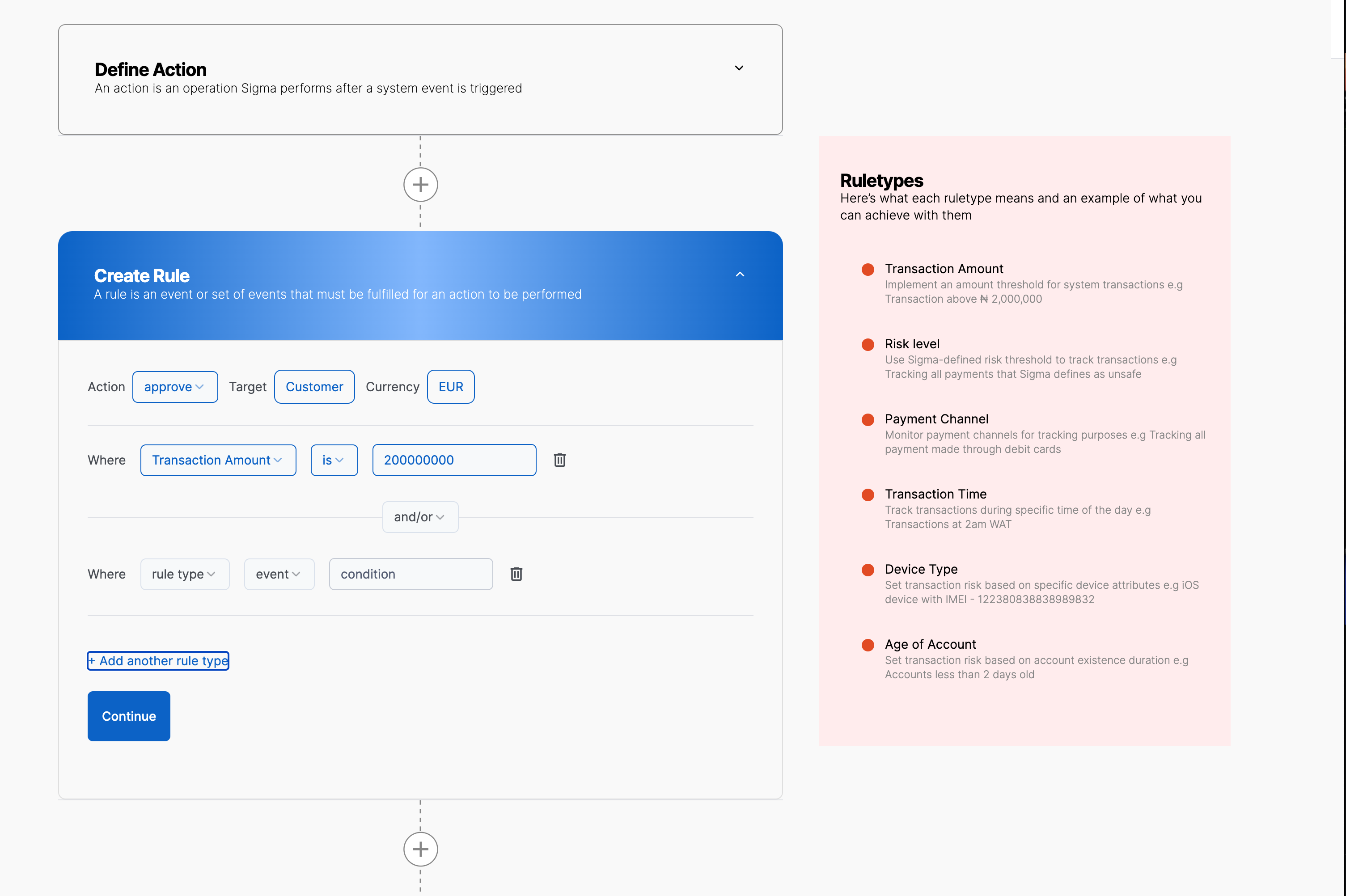

- Fill the required data:

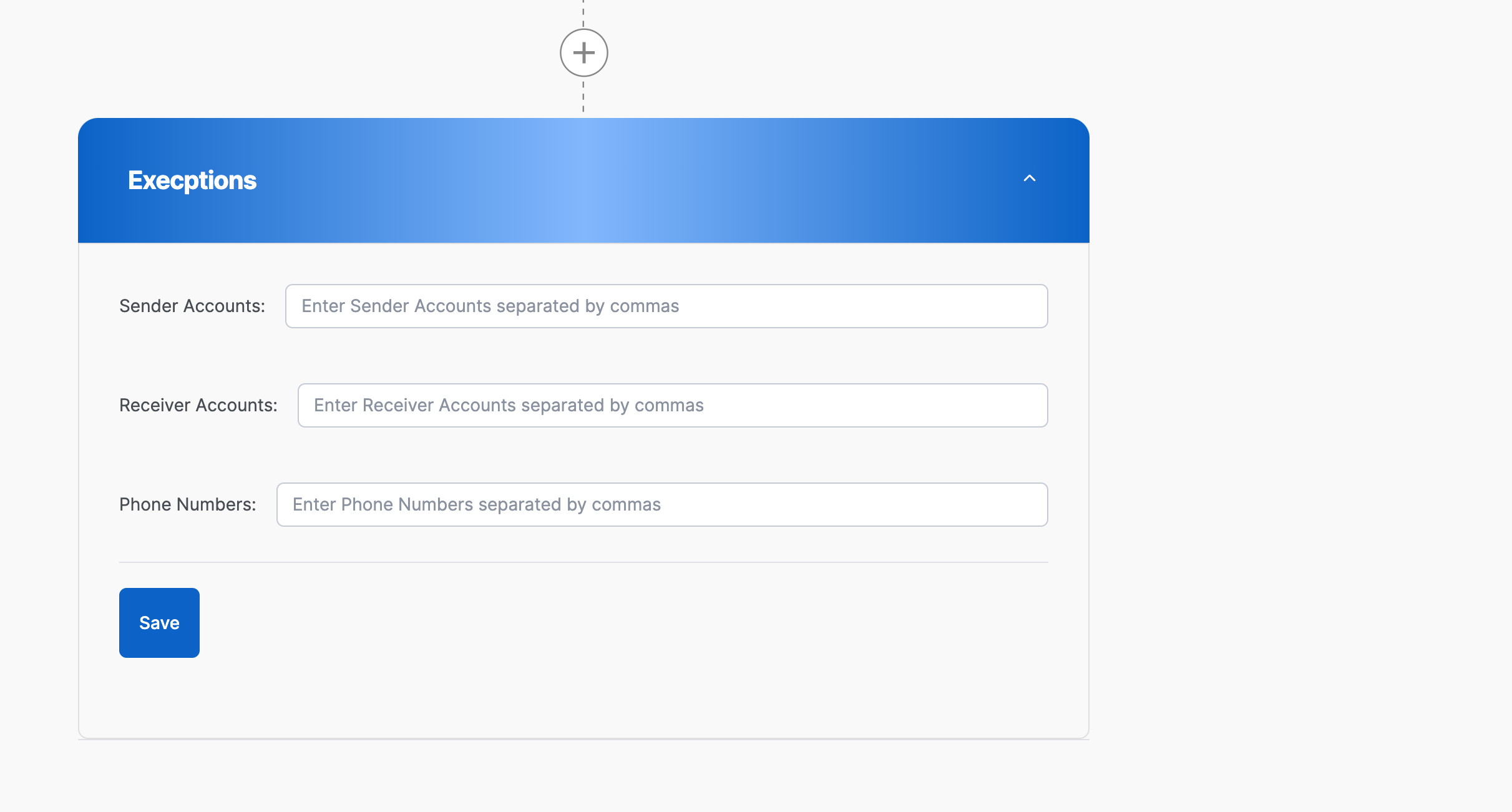

- Fill in your preferred data such as actions to perform, currency, rule target, rule type and exceptions

- Publish:

- Click on publish to publish your rule. 👌

Actions

Here are the typical actions that can be applied to your rule:

- Approve transactions

- Reject transactions

- Move transactions to review

- Send Alert

Typical Rules

Here are examples of some rules:

Transaction Amount

Scenario: You want to automatically review any transaction above 500,000 to ensure it's not fraudulent.

Rule: Review transactions where the amount is greater than 500,000.

Payment Channel

Scenario: You want to reject transactions made through web channels for additional verification.

Rule: Reject transactions where the payment channel is "web."

Device Type

Scenario: You have noticed a pattern of fraud coming from specific device types and want to monitor these more closely.

Rule: Review transactions where the device type is "iOS."

Transaction Time

Scenario: High-risk transactions often occur late at night, and you want to review any transactions during these hours.

Rule: Review transactions where the transaction time is between 11:00 PM and 5:00 AM.

Geographic Location

Scenario: Transactions from certain regions have higher fraud rates, so you want to reject those.

Rule: Reject transactions coming from "Lagos, Nigeria."

Transaction Frequency

Scenario: Multiple high-value transactions within a short period might indicate fraud.

Rule: Review if there are more than 5 transactions above 100,000 within an hour.

Account Status

Scenario: Accounts that were created recently might be used for fraudulent purposes.

Rule: Review transactions from accounts that were created within the last 30 days.

Identity Verification

Scenario: Unverified accounts pose a higher risk.

Rule: Reject transactions from accounts where the identity is not verified.

Time Off Period

Scenario: You may want to block transactions for a specific period of time

Rule: Reject transactions during weekends or public holidays

....And lots more

To create and view rules, go to your dashboard, click Transaction Monitoring -> Rules --> Add Rule.

Our rules can satisfy most use cases, you can also reach out to us for a custom rule.